The National Stock Exchange of India

The National Stock Exchange (NSE) is the largest stock exchange in India, with a market capitalization of over $2.7 trillion USD.

It was founded in 1992 and has quickly become one of the most important players in the Indian economy. Here is a closer look at the history, current status, and role of the NSE in the global economy.

History

The NSE was founded in 1992 as a response to the lack of transparency and efficiency in the Indian stock market at the time. The exchange was established with the goal of creating a more efficient and modern stock market, using cutting-edge technology to streamline trading and reduce costs for investors. The NSE introduced electronic trading in 1994, which revolutionized the Indian stock market and made it accessible to a wider range of investors.

Current Status

Today, the NSE is the largest stock exchange in India, with more than 2,000 listed companies and over 300 million registered investors.

It has a wide range of listings covering many different sectors, including technology, finance, consumer goods, and more. The NSE is known for its innovative and efficient trading platform, which has helped to drive growth in the Indian economy and attract foreign investors.

National Stock Exchange: The Nifty 50

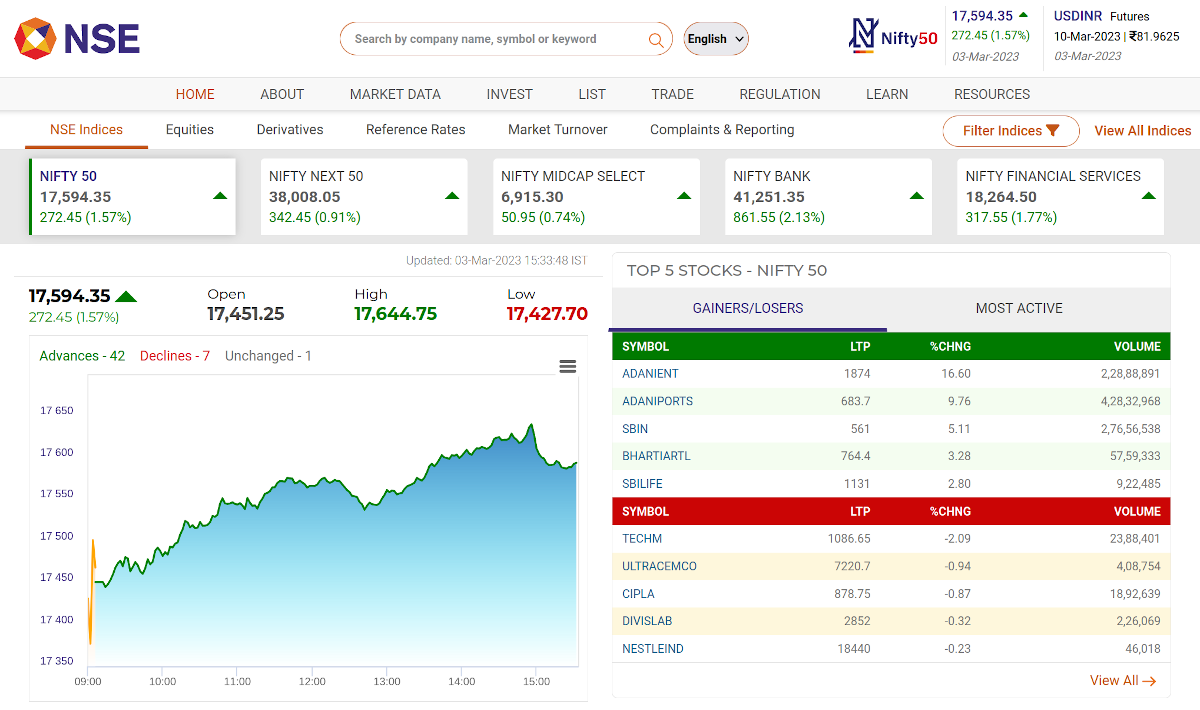

The Nifty 50 on the National Stock Exchange (NSE) of India is a stock market index that tracks the performance of the top 50 companies listed on the NSE.

These companies are selected based on various factors such as market capitalization, liquidity, and financial performance. The Nifty 50 index is widely used as a benchmark for the Indian stock market and is considered a key indicator of the overall health of the Indian economy. The Nifty 50 index is also used by investors as a tool for building diversified portfolios and making investment decisions. Overall, the Nifty 50 on NSE India plays an important role in the Indian stock market and is closely watched by investors, analysts, and market participants.

Role in the Global Economy

The NSE plays a significant role in the global economy, both as a leading stock exchange and as a major player in the Indian economy.

India is the world’s sixth-largest economy, and the NSE is a critical component of the country’s financial system. It provides a platform for investors to buy and sell shares in Indian companies, which helps to fuel economic growth and create jobs.

In recent years, the NSE has become increasingly important on the global stage, as foreign investors have started to take notice of the opportunities offered by the Indian market.

The exchange has attracted a growing number of foreign investors, who are drawn by the country’s high growth rates, large population, and rapidly expanding middle class. As a result, the NSE has become an important destination for investors looking to diversify their portfolios and gain exposure to the Indian economy.

Overall, the NSE is a critical player in the global economy, and an important destination for investors seeking exposure to the Indian market. Its innovative trading platform, wide range of listings, and significant role in the Indian economy make it an attractive option for investors looking to diversify their portfolios and tap into the potential of one of the world’s fastest-growing economies.

Popular Stocks and Sectors on National Stock Exchange (NSE)

The National Stock Exchange (NSE) of India has a wide range of listings covering many different sectors, including technology, finance, consumer goods, energy, and more.

Here is a closer look at some of the most popular sectors and stocks on the exchange.

Technology Sector

The technology sector is one of the most significant on the NSE, with companies like Infosys, Wipro, and Tata Consultancy Services among the largest and most popular listings. These companies are leading providers of IT services, software development, and business process outsourcing, and are known for their cutting-edge technology and innovation.

Finance Sector

The finance sector is also significant on the NSE, with many of India’s largest banks and financial institutions listed on the exchange. HDFC Bank and ICICI Bank are among the most popular listings in this sector, offering a wide range of financial products and services to individuals and businesses in India.

Consumer Goods Sector

The consumer goods sector is growing in importance on the NSE, with companies like Hindustan Unilever and Nestle India performing well in recent years. These companies are known for their popular consumer brands, including personal care products, food and beverages, and home care products.

Energy Sector

The energy sector is also significant on the NSE, with companies like Reliance Industries and Indian Oil Corporation among the largest listings. These companies are major players in the oil and gas industry in India, with a focus on exploration, production, refining, and marketing of petroleum products.

Infrastructure Sector

The infrastructure sector is another significant sector on the NSE, with companies like Larsen & Toubro and Adani Ports and Special Economic Zone among the largest listings. These companies are involved in a wide range of infrastructure projects, including construction, engineering, and port operations.

Overall, the NSE offers a diverse range of listings across many different sectors, providing investors with a wide range of investment opportunities. The exchange is known for its innovative trading platform, which has helped to drive growth in the Indian economy and attract foreign investors. As India continues to grow and develop, the NSE is likely to remain an important destination for investors seeking exposure to one of the world’s fastest-growing economies.